-

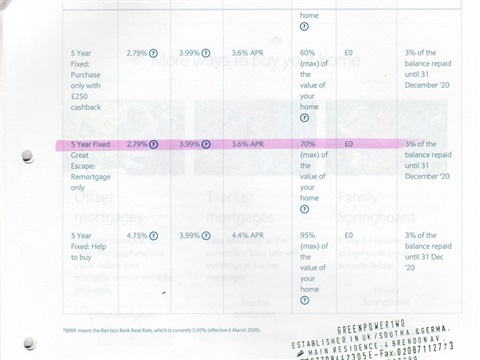

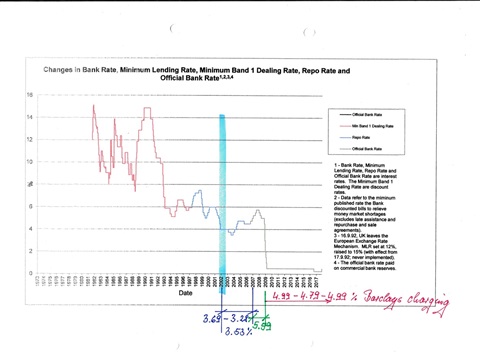

Barclays decrees of interest-notice

interesting, the base rate of England is going up Barclays showing the opposite in times when we no langer have a valid agreement and contractual bindings with this business, any longer, quite so?

-

Barclays decrees of interest- notice

interesting, the base rate of England is going up Barclays showing the opposite in times when we no langer have a valid agreement and contractual bindings with this business, any longer, quite so?

-

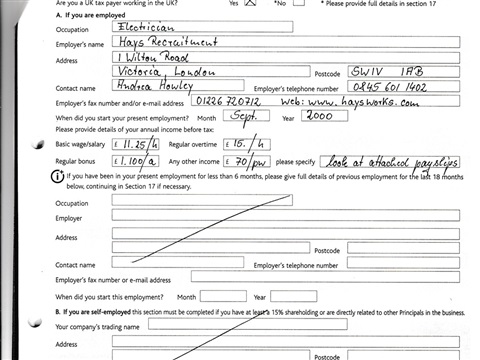

HMRC - inland revenue being warned evry year about this persisting inconvenience

2020-2021 none VAT tax return received this attachment in order to warn even this National admin about the persisting inconvenience at both UN committed Sovereignties and member of the charters of common wealth, just to make sure there will be no note like we received from Barclays stating we may have missed the opportunity to complain on time, quite?

-

HMRC - inland revenue being warned evry year about this persisting inconvenience

2020-2021 none VAT tax return received this attachment in order to warn even this National admin about the persisting inconvenience at both UN committed Sovereignties and member of the charters of common wealth, just to make sure there will be no note like we received from Barclays, stating we may have missed the opportunity to complain on time, quite?

-

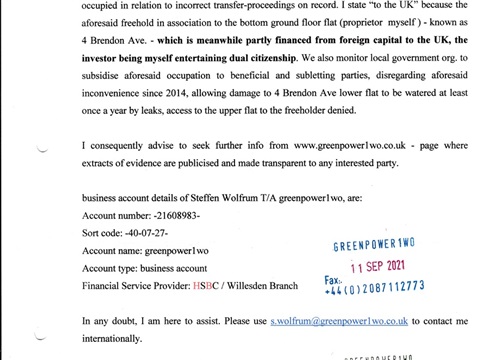

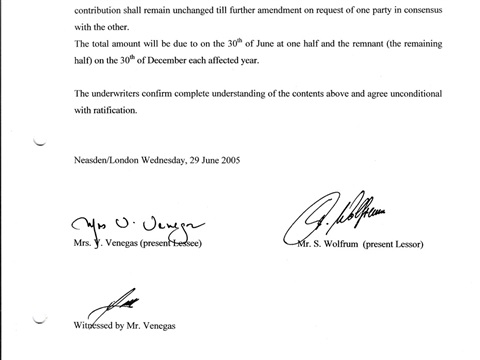

amendment to lease 4A Bredon Ave.

Since 2014 this amendment appears absolutely disregarded and services provided to this upper flat remain unpaid , the lower flat being watered by leaks from the upper flat at least once a year, access denied for the freeholder and subletting without consent from the proprietor / lessor of the land of effect. Tenancy appears being made to a social benefit recipient supposed to be paid from public funds without any contribution to the accumulating unpaid agreed charges as well as caused loss and damage to 4 Brendon Avenue interior by aforesaid constant leaks. Local Authorities seem to turn a blind eye on this unsustainable situation, disregarding any warning on record even through covid-19 experience.

-

amendment to lease 4A Bredon Ave.

Both Barclays Plc and the arbitrating local National Court of Justice know about aforesaid having been warned in 2015-2016 proceedings, already.

-

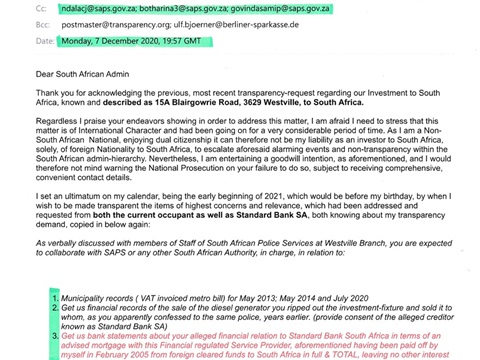

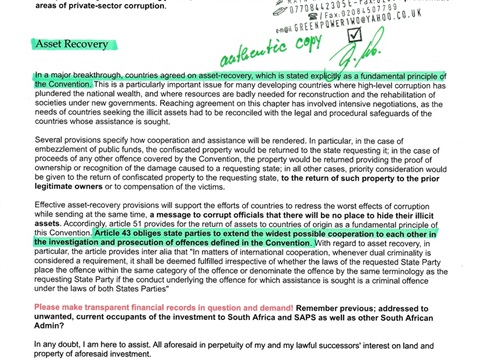

continued query South African admin-performance

The latest investigation - when being in South Africa - finalised in this appearing to be totally ignored in terms of the requested essential transparency till today - Update Sep 2021. Baring in mind that Barclays Plc took advantage to lodge a fresh approach at the same national, local court of justice for the very same matter, which had been arbitrated in 2016 already, during the defendant's national absence from the UK, without notice by email or phone, I personally note, strange, isn't it?

-

continued query South African admin-performance

ditto

-

continued query South African admin-performance

ditto

-

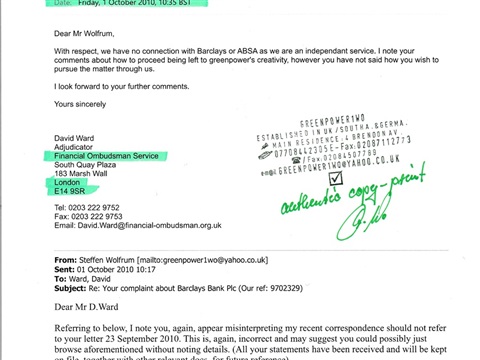

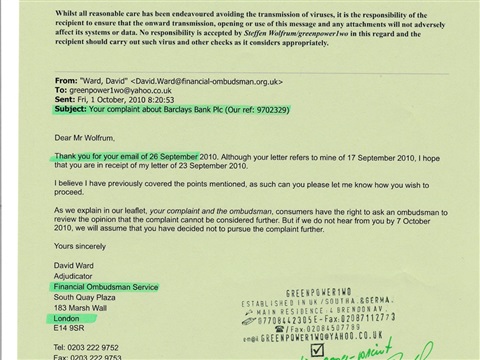

Braclays complaint in 2010

In Barclays most recent correspondence it is to note that the Bank appearing to entertain views, the debtor failed to complain on time, which is indeed surprising in relation to the fact that solid evidence proves even the regulating National, Financial Authority had been informed in 2010 well ahead of what followed in the years 2012 -2016 and then later in 2020, quite so?

-

Braclays complaint in 2010

ditto

-

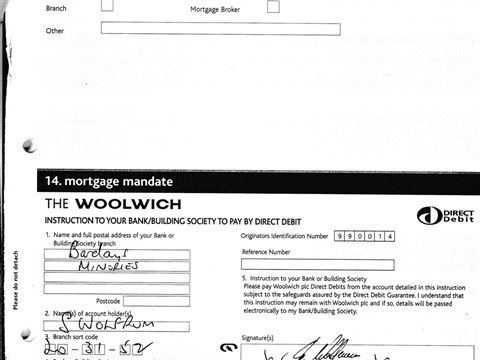

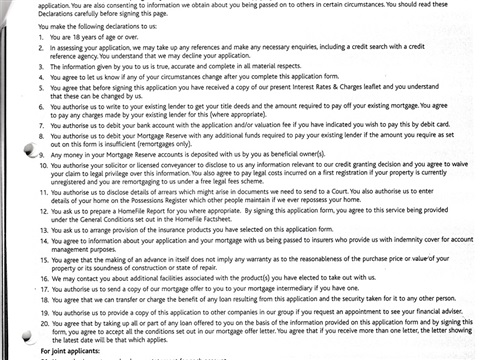

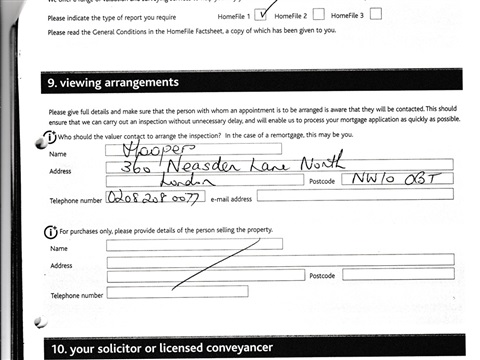

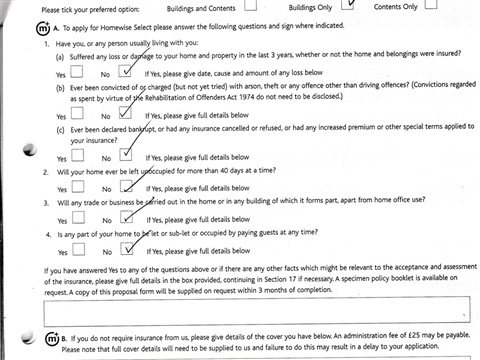

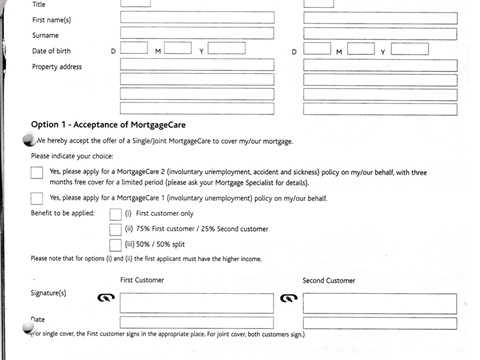

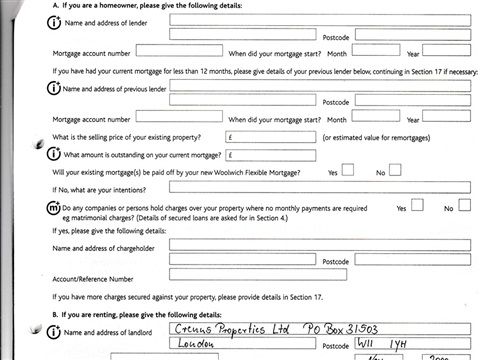

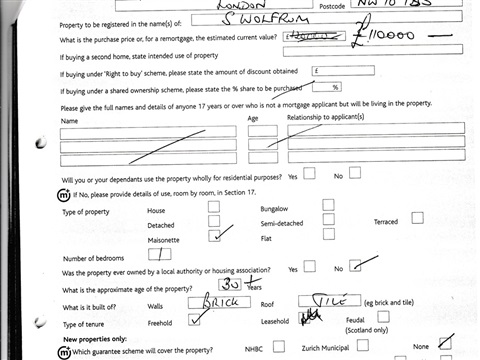

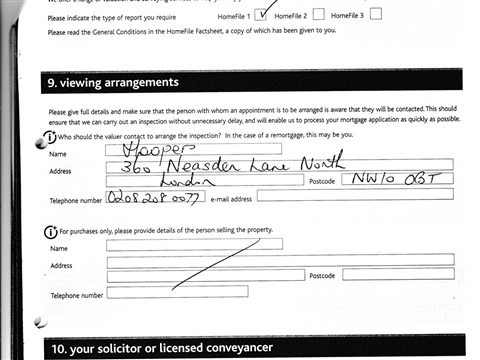

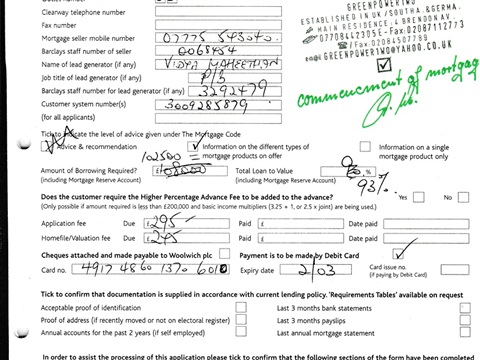

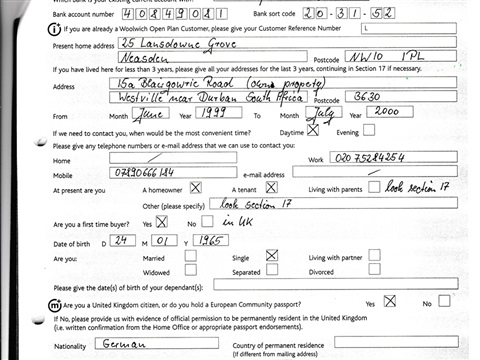

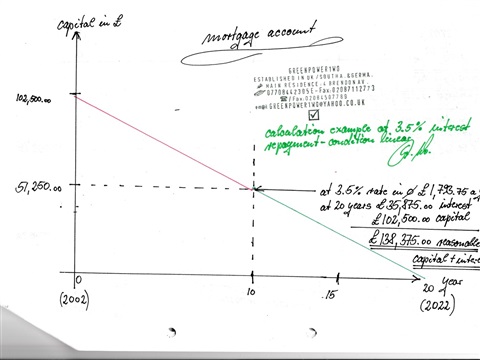

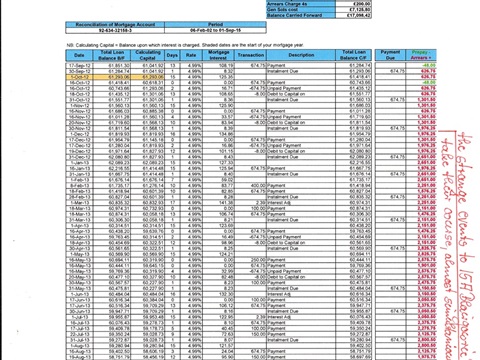

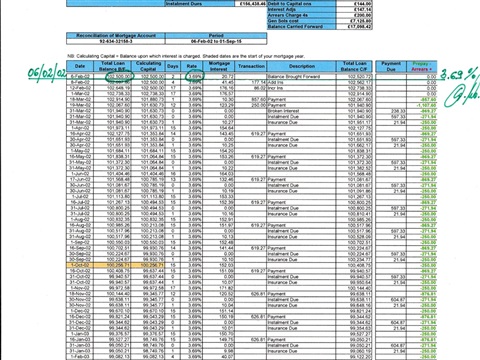

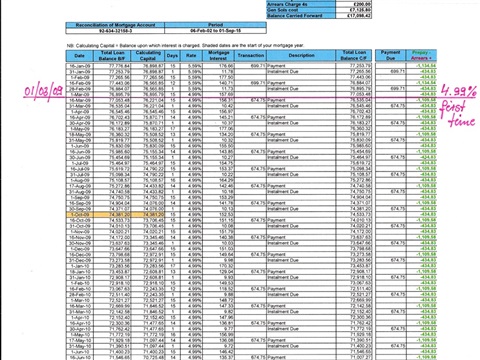

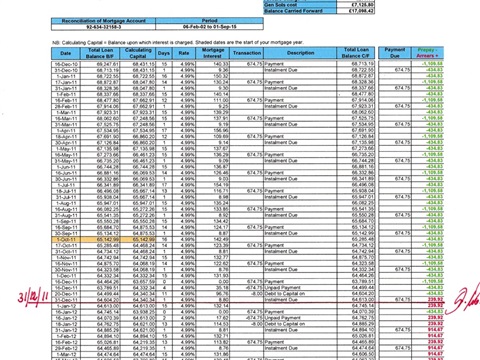

The civil/financial aspect of Barclays performance

The original mortgage agreement made with Barclays Plc at commencement of aforesaid mortgage

-

The civil/financial aspect of Barclays performance

The original mortgage agreement made with Barclays Plc at commencement of aforesaid mortgage

-

The civil/financial aspect of Barclays performance

The original mortgage agreement made with Barclays Plc at commencement of aforesaid mortgage

-

The civil/financial aspect of Barclays performance

The original mortgage agreement made with Barclays Plc at commencement of aforesaid mortgage

-

The civil/financial aspect of Barclays performance

The original mortgage agreement made with Barclays Plc at commencement of aforesaid mortgage

-

The civil/financial aspect of Barclays performance

The original mortgage agreement made with Barclays Plc at commencement of aforesaid mortgage

-

The civil/financial aspect of Barclays performance

The original mortgage agreement made with Barclays Plc at commencement of aforesaid mortgage

-

The civil/financial aspect of Barclays performance

The original mortgage agreement made with Barclays Plc at commencement of aforesaid mortgage

-

The civil/financial aspect of Barclays performance

The original mortgage agreement made with Barclays Plc at commencement of aforesaid mortgage

-

The civil/financial aspect of Barclays performance

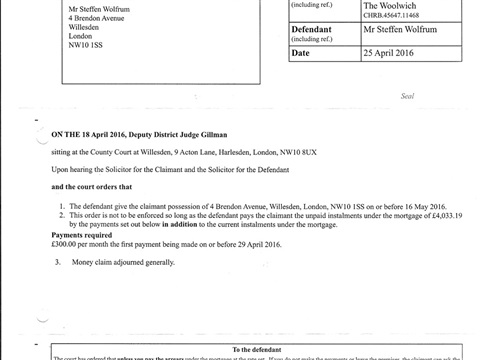

The order made by District Judge Gillman, sitting & arbitrating at a local County Court takes reference to the mortgage account, solely, leaving the mortgage reserve/ current account-claim disregarded. All sitting parties accept his order unchallenged, no appeal against aforementioned order known till today (Aug. 2021), the defendant, Steffen Wolfrum, respectfully serving District Judge Gillman's order , even through difficult times of covid-19 stipulations and inconvenience without interruption till 2021, when it became obvious his order being fulfilled, even at a controversial 5% interest rate in average over the lifetime of the mortgage in question. All parties accepted foreign capital to serve the order as advised by the defendant at Court hearings.

-

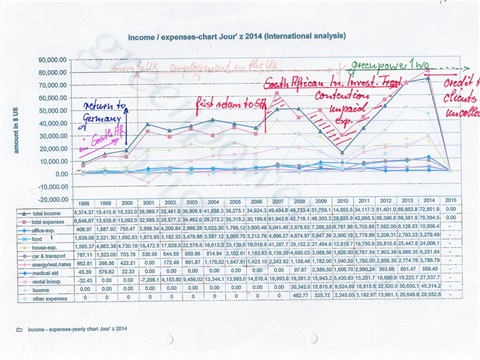

The civil/financial aspect of Barclays performance

The defendant's graphic about his financial performance clearly show the financial constrains the South African admin performance had triggered at relevant times, again to remember, which to Barclays Plc's opinion has no relevance, at all, so to their statement in Aug 2021, quite so?

It further clearly reflects the worldwide crash on the market in the year 2008 and the following in 2009 when recovery commenced in 2010.

Remember, 2009 was the year Barclays Plc applied the controversial 4.99% interest, in relation to the ultra low base rate, set by the Bank of England. (originally agreed variable interest rates)

-

The civil/financial aspect of Barclays performance

just another piece in the puzzle making it difficult to accept there was no deliberate, pre-meditated motivation behind this very remarkable admin performance with international relation-links. At the time Barclays Plc did see no alternative than proceeding through court one of the Bank's very own product indicate how the market had been at times, correct?

-

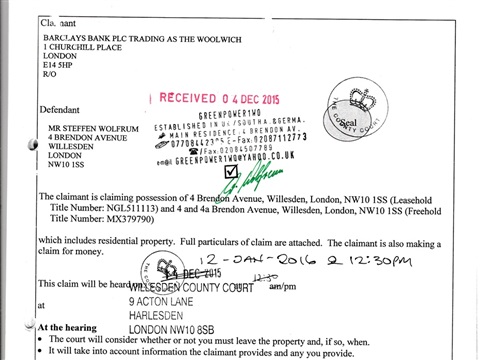

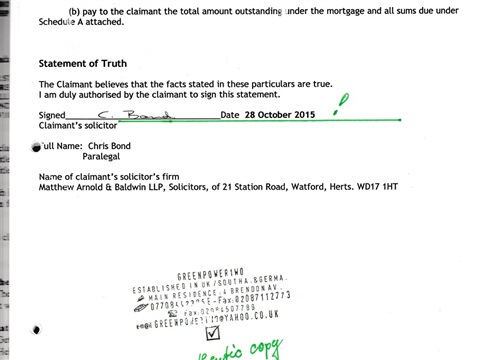

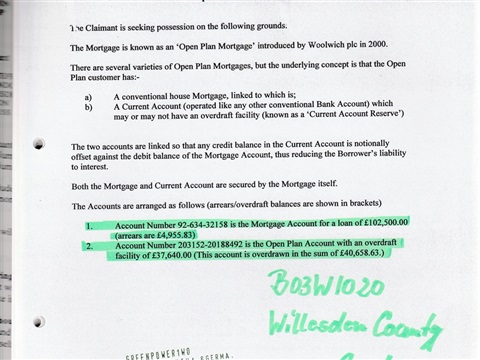

The civil/financial aspect of Barclays performance

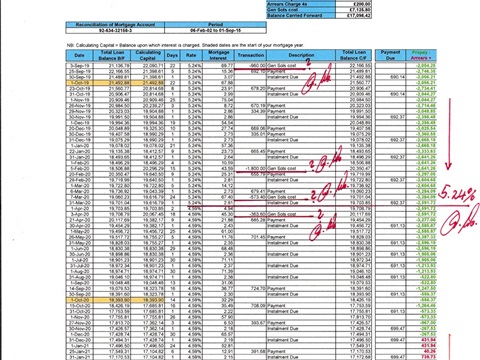

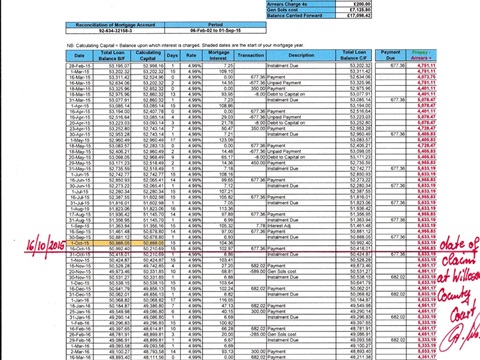

The Barclays-claim presented by Barclays Plc's solicitors, asking for arbitration at the local Court of Justice, at the time of aforesaid claim, indicate both accounts, the mortgage and the mortgage reserve/current account

-

The civil/financial aspect of Barclays performance

dated and verified by Barclays Plc's Solicitors at the time of presentation

-

The civil/financial aspect of Barclays performance

asking for repayment for both accounts, regardless the fact that the controversial high interest rate in relation to the base rate set by the Bank of England from 2009 , at a disputed rate of 4,99%, set by Barclays Plc - over three years till 2011 - the time of the alleged default should have accumulated about, generated not less than £1,100.oo a year in Barclays Plc's calculation and presented records, which creates substantial doubt for the "default-claim". The controversial mortgage reserve/current account spent for the land & property-restoration , known as 15A Blairgowrie Road, 3629 Westville to South Africa appears here too, as a default-claim, but Barclays Plc sees no relevance whether or not Barclays Plc did entertain awareness about the murky and dubious events generated by the South African Admin, disregarding the international status, there, too, quite?

-

The civil/financial aspect of Barclays performance

Here an official extract of the development of the Base rate set by the Bank of England, Barclays being believed to receive financial funds from in relation to the interest charges Barclays Plc applied to the mortgage agreement in question

-

The civil/financial aspect of Barclays performance

Here a simplified calculation of responsible rates through the lifetime of a linear development of a mortgage in question to responsible, fair and reasonable service providing-performance, quite so?

-

The civil/financial aspect of Barclays performance

Barclays Plc, at this point, to their very own statements having received and collected not less than 60,796.49, for interest, solely, regarding capital well more than the originally borrowed amount of monies - to our own records -

but Barclays Plc is still not satisfied, demanding more than 17,000.oo, on this account, adding solicitor charges to the account, which is not in arrear and actually already overpaid - even at a doubtful interest rate of 5% in average - to what evolves before us, quite?

-

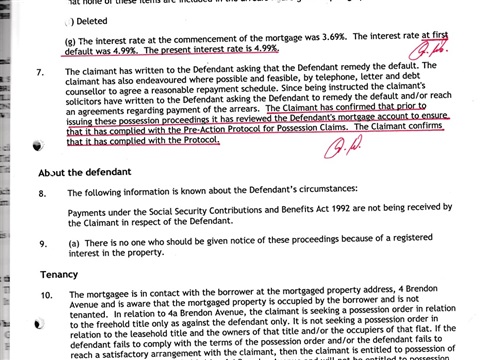

The criminal aspect of Barclays performance

Another very strange statement in terms of the law; Barclays apparently having followed up pre-action protocol, quite so?

-

The criminal aspect of Barclays performance

At court proceedings instigated by Barclays the capital had been reduced from 102,500.oo - originally borrowed - to 50,992.40, meaning the financial golden rule of 50% borrowed against 50% own capital already met. Further adding the interest Barclays Plc has collected by that date the total of the borrowed monies already being collected by Barclays at this point, quite? Noting that the questionable high interest rate of 4.99% applied since 2009, already, three years back, when the base rate was sitting at not more than 1% I believe the Bank would have had very different tools to approach this matter in pre-action protocol but decided to go to Court stating they complied to pre-action protocol, seeking Court assistance as the very last resource, quite so?

-

The criminal aspect of Barclays performance

Strangely at the almost same time, simultaneously , the events in the South African Republic attacking our investment in Land and Property there, having triggered the financial constrains in the UK, seems to have "no relevance" to Barclays Plc who refuse to make transparent whether or not Barclays Plc had awareness of what is being exercised to this land and property the mortgage reserve account being used for, correct?

-

The criminal aspect of Barclays performance

commencment of the mortgage in question in 2002

-

The criminal aspect of Barclays performance

the actual date of "first default" to Barclays records (in origin), checked and received not before August 2021, despite claims to make transparent the total lump

sum of all remittances having been submitted to Barclays Plc over the life time of the mortgage in question, including mortgage reserve remittances, requested in Dec 2020 -

The criminal aspect of Barclays performance

Barclays and their Solicitors stated to the arbitrating local Court in 2015.

Quote: "The interest rate at first default was 4.99%..." making it look like as it had been a penalty or perhaps a "risk" to the business but indeed the interest rate had been changed to 4.99% in 2009, already, shortly after the financial meld down in 2008, Base and interest rates plummeting world-wide ( to around 1% ) and never recovered till then. There had been NO DEFAULT at this time (2009)! Consequently the default calculation based on the controversial high interest rate of 4.99% in relation to the actually agreed variable rates generates an incorrect presentation, I conclude, meaning the entire presentation to Willesden County Court in 2015 appears in a misleading image, quite so? There is no hint this having happened by mistake!

Barclays Plc's response 04 Aug 21 (page1)'

I am stunned, sorry did I get this correctly, a proffesional accuntant to be consulted to extract the requested total sum we have been paying to Barclays PLC on both accounts, since commencment-date?

Barclays Plc's response 04 Aug 21 (page2)'

UK Bank's response towards our request to become transparent regarding the controversial lending for the South African investment in need in 2007 and the following years till 2011, remarkable, quite?

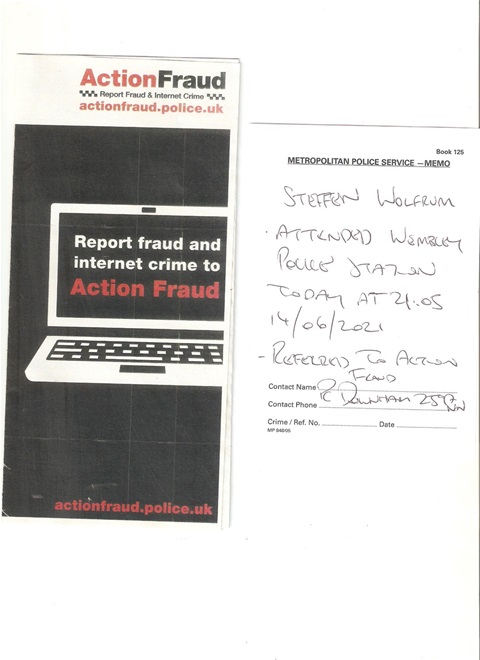

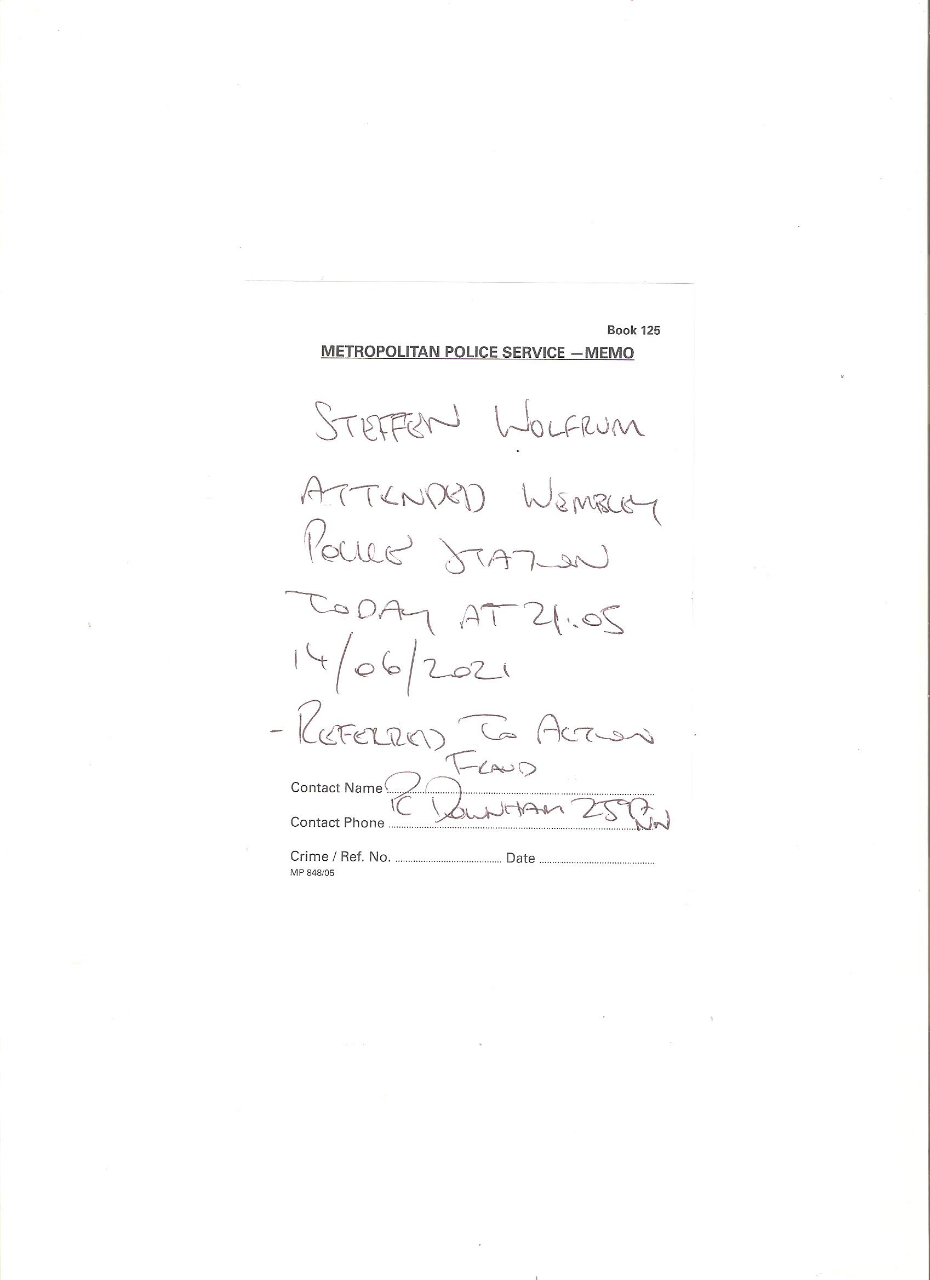

visiting Wembly Police Station on 14 Jun 2021 in order to report the concerning, undesirable and non-sustainable admin performance, the consulted officer in charge suggested contacting "Action Fraud", which we did by phone on the 15th June 2021; 10:00 AM, conversation recorded at both ends of the line in mutual consent, speaking to Amal at Action Fraud. Member of staff stated after consulting others, that this National Department of the British Police not to be permitted "to investigate into the bank"

My response: "very interesting"

Auf Anraten der Polizeistation Wembley schlug der Beamte vor, "ActionFraud" zu kontaktieren, was wir am 15. Juni 2021 gegen 10 Uhr getan haben, wobei das Gespräch an beiden Enden der Leitung in Zustimmung aufgezeichnet wurde.

Im Gespräch mit AMAL bei ActionFraud verstanden als Abschlusserklärung der britischen Polizeiabteilung, die zu Protokoll gegeben wurde: "Wir dürfen keine Angelegenheiten gegen die Bank einleiten "

Meine Antwort: "Sehr interessant"

investigation commences; as to evidence there appear links between the activities in South Africa and what happened in the UK, also it appears simply incredible Barclays PLC not having had and having the financial intelligence seeing the cash flow they now appear having serious difficulties to make transparent since Dec 2020. Also in question gets the Willesden County Court performance which gets mysteriously quiet about the fact the this court of justice seems to contradict its own order and ruling sitting with Judge Gillman in 2016. this Court rules in absence shortly before covid-19 restriction hits in my absence the same matter again, very differently. appeal to the ruling in 2020 remains without any further response other than the acknowledgement of reception , stand June 2021.

Latest comments

I am back to London now after 5 full moth in Southern Africa www.greenpopwer1wo.co.uk updated just look for any thing ending 2022

I am back to London now after 5 full moth in Southern Africa www.greenpopwer1wo.co.uk updated just look for any thing ending 2022

web-page has been up-dated with new interesting discoveries and disturbing evidence that climate change leaves no part, solo, isolated or immune. She is clearly having the hump, all I can say now!

cheers for your message and request, yes I shall be back to Southern Africa in December, fingers crossed, as I am depending on third parties like carries e.g. and Authorities, quite so?