Barclays Bank 1-21

The final attempt now became a demand to make transparent all monies Barclays PLC having been paid since the commencement of this mortgage agreement in Feb 2002, awareness of Standard Bank performance

-

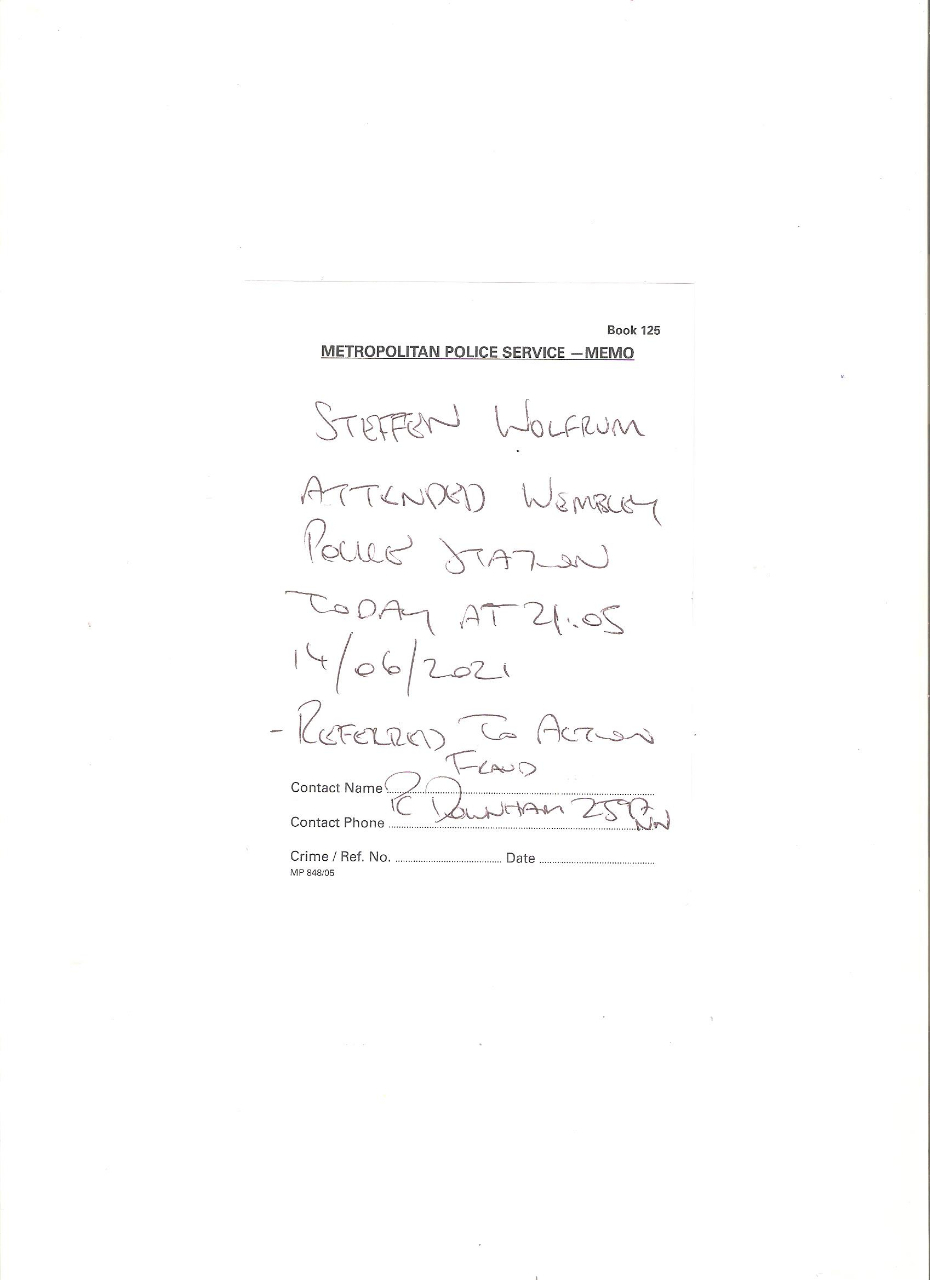

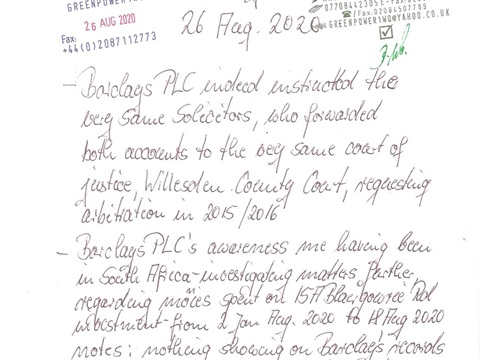

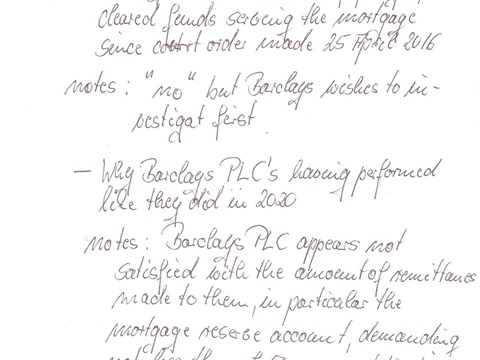

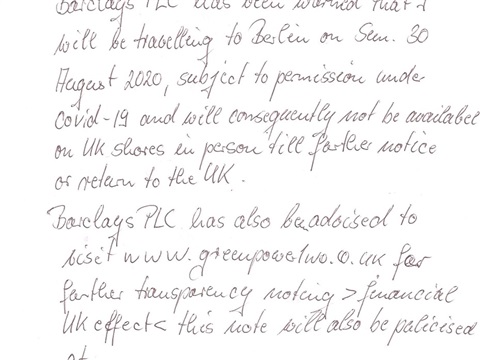

Telecommunication with Barclays Plc 26 August 2020

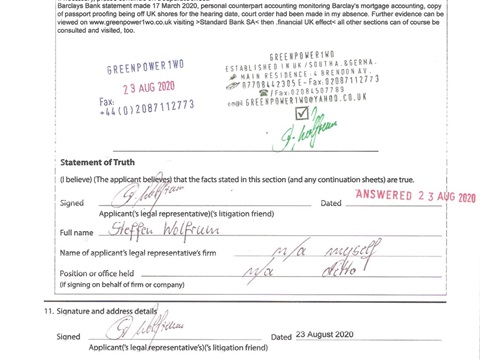

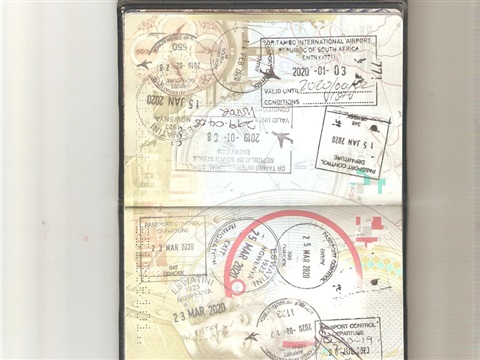

On 26 August 2020, instigated by my request, I talked to the legal team at Barclays in order to distinguish whether or not there had been pre-meditated, deliberate attempts in order to gain further advantages and powers, in this regard, during my stay in Southern Africa ( page -1-)

-

Telecommunication with Barclays Plc 26 August 2020

On 26 August 2020, instigated by my request, I talked to the legal team at Barclays in order to distinguish whether or not there had been pre-meditated, deliberate attempts in order to gain further advantages and powers, in this regard, during my stay in Southern Africa ( page -2-)

-

Telecommunication with Barclays Plc 26 August 2020

On 26 August 2020, instigated by my request, I talked to the legal team at Barclays in order to distinguish whether or not there had been pre-meditated, deliberate attempts in order to gain further advantages and powers, in this regard, during my stay in Southern Africa ( page -3-)

-

challenging the strange actions made by Barclays PLC during my investigation in South Africa

We now need to figure out whether or not there are direct links between people acting in the south so similar to what is happening in the north of this commonwealth link

-

challenging the strange actions made by Barclays PLC during my investigation in South Africa

Also, is there deliberate motivation behind this meaning pre-meditated action or just mistake or coincident?

-

challenging the strange actions made by Barclays PLC during my investigation in South Africa

proof me being on my SA investigation course, off UK shores from 2 Jan 2020 till 17 August 2020, delayed inbound back to London UK caused by covid-19 regulation.

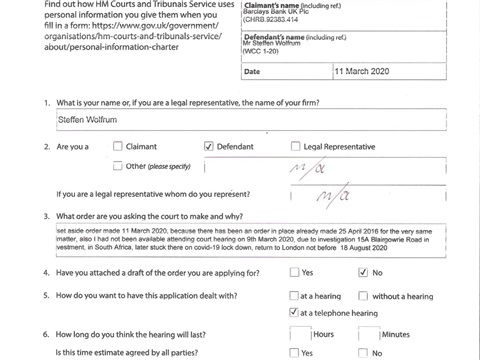

willesden County Court 1-20 defence B03W1020-G00WI229

My response to this utterly incomprehensible performance from both the Court as well as the Creditor Barclays PLC, which is simply unacceptable for technical reasons as well as for legitimate reasons.

Bank of England base-rate

To any interested parties' opinion-building - the official transparency about the National Bank's governing guideline the regulated lender borrows money from.

Barclays - mortgage minitoring

The accounts at the time of my return to the UK 18th August 2020, having discovered that meanwhile, the creditor has proceeded, as well as Willesden Country Court, has arbitrated, again, on 9th March

willesden County Court 1-19 defence B03W1020

In precaution the lender the matter again to escalate to third deciding parties I contact local arbitrating Court of Justice in order to warn about my availability to attend matters in person.

woolwich 2-19 (1)

Final attempt to seek Barclays attention in order to change course to fair and transparent & sustainable conditions

Barclays' respons to 14 July Qyery 19.11.06 Letter to Mr Wolfrum (Final)(51815304_1) (1)

Utterly incredible the language and the quality of the Creditor's Solicitors' response after not less than three month. What is going on here - hand-writing so similar to Standard Bank SA , quite so?

woolwich 1-19 (query 14th July after Barclays sought solicitor-attentence, again)

The creditor in the UK, Barclays PLC, who financed the restoration in South Africa with a so called mortgage-reserve account at times, clearly agreeing to the spending there, being questioned.

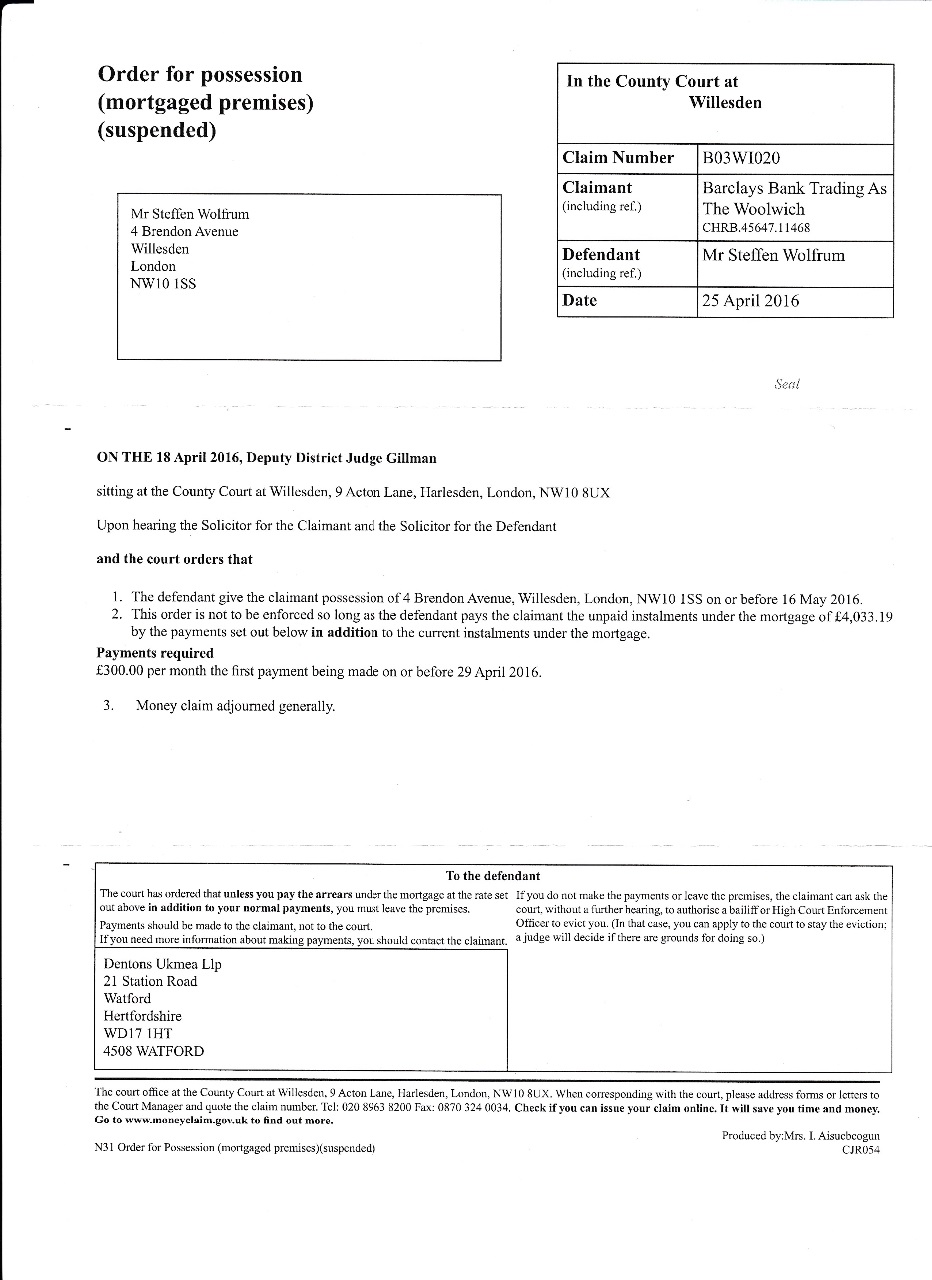

Final Court Order in the Court appearance - initiated by Barclays PLC - regarding short default (arrears questionable and argued due to unjustified high interest-charges by Barclays, in relation to agreed variable interest rate since 2009, base rate sitting below 1% by the Bank of England) Barclays charging well above 4% almost 5% in average, over a very considerable period of time an estimated half of the mortgage life-time, probably even longer at maturity.

4BrAv Barclays-Court order 25 April 2016IMG_20190501_0001_NEW

for any interested easy down-load facility this document being available in PDF here.

woolwich 2-18

The very latest request/appeal to the Bank in order to release equity from the London Invest for renewable and sustainable energy-generation, also requesting to accept fair termination, being rebuffed

Because monies from a so called Mortgage reserve account associated to The London Investment, having been used for restoring tenable and insurable nature at SA Investment, it appears remarkable that this financial service provider seems charging an interest rate well above the base rate set by the Bank of England at mainly 4.99% , despite we should enjoy variable rates as it had been agreed to. The original standard variable rate is idling around 3.6 % at the beginning of the mortgage agreement, when the base rate had been much higher than later on , in particular after the fixed term ended in the early beginning of 2009. Since that time the charged rate did not change very much and appears to have been in a relation of 4.99% to less than 1% (base rate of the Bank of England) for many years. A repossession attempt in Dec 2015 stated by the Bank "the interest rate at first default was 4.99%" suggesting the interest rate had been some sort of justification in an alleged default caused by the events trigger with our South African investment known as 15A Blairgowrie Road, The Bank strangely seems to justify differently today, compared what she produced as justification to third deciding parties at times of repossession-attempts of 4 Brendon Avenue, which failed.

IMG_20180603_0003

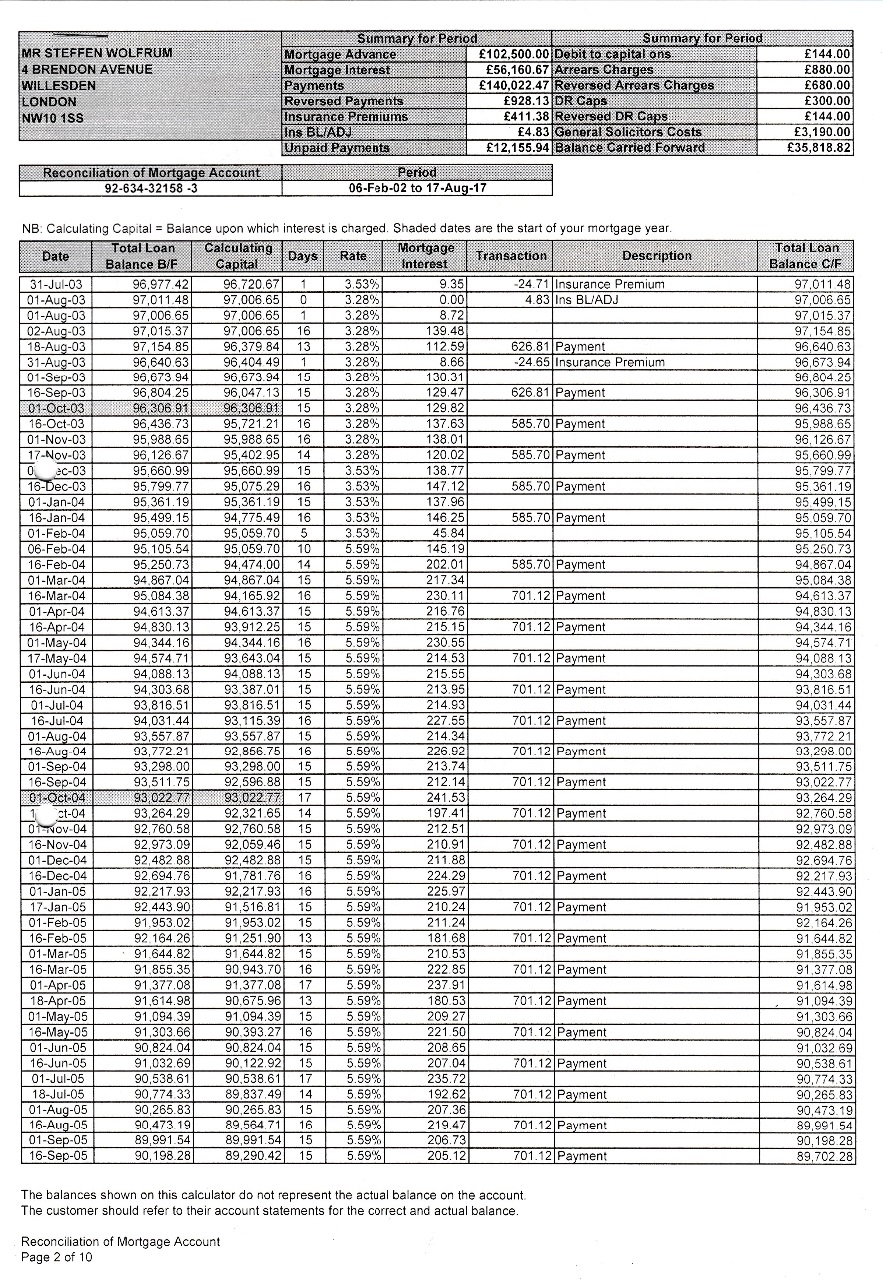

Barclays statement and confirmation of received remittances in August 2017.

total amount submitted to Barclays at this time, more than £ 140,000.oo already.

original amount borrowed: £102.500,oo

IMG_20180603_0004

Barclays statement and confirmation of received remittances in August 2017.

total amount submitted to Barclays at this time, more than £ 140,000.oo already.

original amount borrowed: £102.500,oo

IMG_20180603_0005

Barclays statement and confirmation of received remittances in August 2017.

total amount submitted to Barclays at this time, more than £ 140,000.oo already.

original amount borrowed: £102.500,oo

IMG_20180603_0006

Barclays statement and confirmation of received remittances in August 2017.

total amount submitted to Barclays at this time, more than £ 140,000.oo already.

original amount borrowed: £102.500,oo

IMG_20180603_0007

Barclays statement and confirmation of received remittances in August 2017.

total amount submitted to Barclays at this time, more than £ 140,000.oo already.

original amount borrowed: £102.500,oo

IMG_20180603_0008

Barclays statement and confirmation of received remittances in August 2017.

total amount submitted to Barclays at this time, more than £ 140,000.oo already.

original amount borrowed: £102.500,oo

IMG_20180603_0009

Barclays statement and confirmation of received remittances in August 2017.

total amount submitted to Barclays at this time, more than £ 140,000.oo already.

original amount borrowed: £102.500,oo

IMG_20180603_0010

Barclays statement and confirmation of received remittances in August 2017.

total amount submitted to Barclays at this time, more than £ 140,000.oo already.

original amount borrowed: £102.500,oo

IMG_20180603_0011

Barclays statement and confirmation of received remittances in August 2017.

total amount submitted to Barclays at this time, more than £ 140,000.oo already.

original amount borrowed: £102.500,oo

Latest comments

I am back to London now after 5 full moth in Southern Africa www.greenpopwer1wo.co.uk updated just look for any thing ending 2022

I am back to London now after 5 full moth in Southern Africa www.greenpopwer1wo.co.uk updated just look for any thing ending 2022

web-page has been up-dated with new interesting discoveries and disturbing evidence that climate change leaves no part, solo, isolated or immune. She is clearly having the hump, all I can say now!

cheers for your message and request, yes I shall be back to Southern Africa in December, fingers crossed, as I am depending on third parties like carries e.g. and Authorities, quite so?